How to obtain a Portugal residence permit under the investment fund option?

Brittany Collins

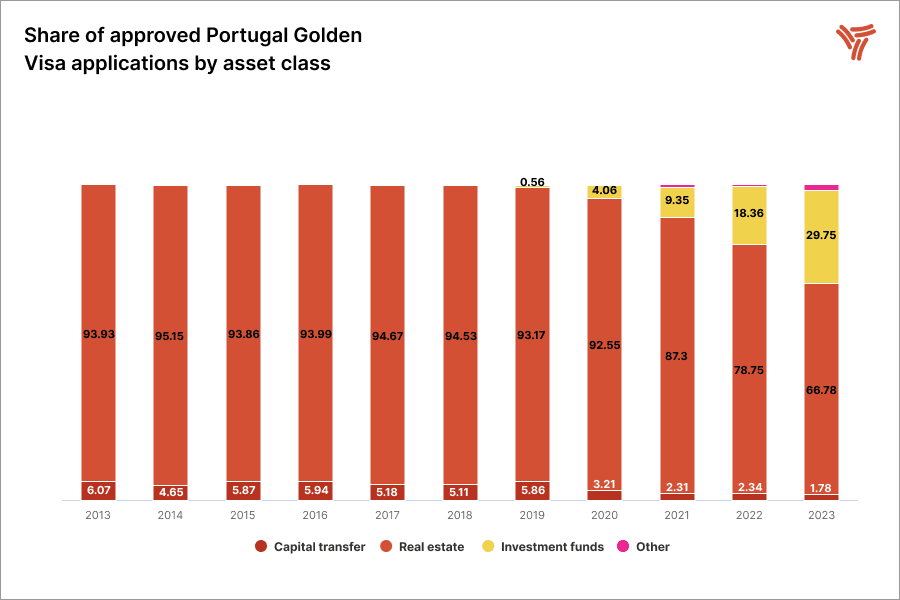

The Portugal Golden Visa program underwent significant changes in 2023. Investors can no longer qualify by purchasing real estate or making a capital transfer.

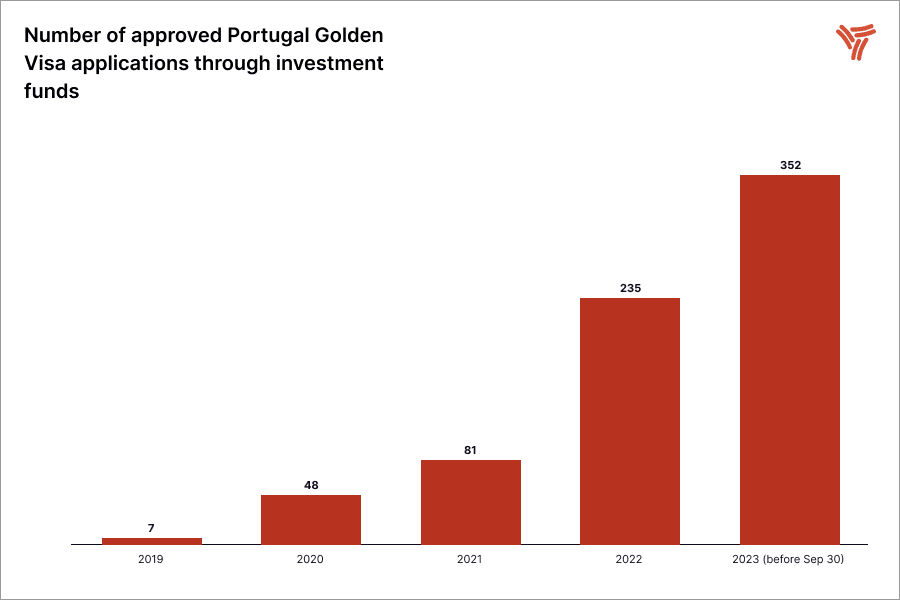

Other options, however, remain available. Investment fund units are one of them, and it has grown in popularity in recent years, even before the changes.

How to obtain a Portugal residence permit under the investment fund option?

Share:

What is a Portugal Golden Visa investment fund?

Participating in an investment fund is one of the eligible options for the Portugal Golden Visa.

An investment fund is generally a pool of money collected from multiple participants to invest in various projects for profit. The pool is managed by a company that allocates funds based on its strategy, expertise, and the risk levels outlined in the fund’s documents.

The minimum investment in fund units to qualify for the Portugal Golden Visa is €500,000. Funds can accept lower investments, but they will not qualify for the Golden Visa program.

Сomparison of the Portuguese investment fund option to other Golden Visa options

How are Portuguese investment funds regulated?

Portuguese investment funds are supervised by the Comissão do Mercado de Valores Mobiliários, or CMVM. This is Portugal’s securities market commission, which requires regular reporting to maintain investors’ trust and uphold standards.

Key aspects of the regulation include:

Independent audits. Funds must be audited by external firms to verify financial reporting.

Depositary bank affiliation. Funds must appoint a depositary bank to hold its units.

Portugal aligns with European Union financial regulations. Asset management principles are outlined in the government’s official gazette.

Discover 9 most popular Golden Visa programs and choose the best one for your goals.

Who is eligible for a Portugal Golden Visa by investing in funds?

Requirements for investors. All potential Portugal Golden Visa applicants willing to take the investment fund route must meet the following requirements:

be a non-EU, non-EEA, and non-Swiss citizen;

be over 18 years old;

have a clean criminal record;

have no socially dangerous diseases;

have medical insurance with full coverage.

Some investment funds may have extra requirements for the applicants:

have a certain level of knowledge about financial instruments, such as company stocks, government bonds, or funds;

prove substantial legitimate money for investment.

Requirements for family members. The main applicant can include the following family members in the application for a residence permit by investment:

spouse or legal partner;

children under 18 years of age;

children over 18 and up to 26 years of age who are single, financially dependent on the investor, and enrolled as full-time students;

parents of the investor and their spouse.

If parents are under 65 years old, they must be financially dependent on the investor.

Requirements for investment. A single Golden Visa applicant invests at least €507,050 if the fund units option is chosen.

Portugal Golden Visa fund investment costs and fees

Portugal Golden Visa investment funds: list of options

Investment funds directly or indirectly related to real estate are also not eligible for the Portugal residency by investment program. However, there are plenty of investment funds specialising in other fields, including technology, agriculture, and environment (ESG).

All the funds listed below are certified by the Portuguese Securities Market Commission, or CMVM.

Investment funds eligible for the Portugal Golden Visa Program

In case of open-ended investment funds, the investor can make an exit at any moment without barriers. However, to qualify for the Portugal Golden Visa, they must maintain a holding period of five years.

Documents required to apply for a Portugal Golden Visa

Any investor willing to participate in the Portugal Golden Visa program through purchase of fund units must submit a minimal set of documents:

passport and its copy;

bank statements confirming legitimate money;

proof of tax identification number in the country of origin or residence;

proof of medical insurance;

clean criminal record certificate;

declaration of honour to confirm the intention to maintain investment for at least 5 years.

Real estate purchase and capital transfer options are cancelled since October 2023, making investment funds the most popular remaining alternative

Applying for Portugal Golden Visa by investment fund: a step-by-step guide

The whole process of obtaining a residence permit in Portugal can take between 8 and 10 months. Almost all the steps can be done remotely, and the investor’s presence is required only on two occasions.

2 weeks

Choosing the fund to invest in

Experts in the investment migration field help to choose the most suitable fund based on their experience. Investors don’t need to travel to Portugal at this stage.

Experts in the investment migration field help to choose the most suitable fund based on their experience. Investors don’t need to travel to Portugal at this stage.

1—2 weeks

Obtaining an individual taxpayer number

Each potential investor receives a nine-digit taxpayer number, NIF, to perform any official or financial activity in Portugal. The procedure can be done remotely or in person.

Each potential investor receives a nine-digit taxpayer number, NIF, to perform any official or financial activity in Portugal. The procedure can be done remotely or in person.

1+ month

Setting up a bank account in Portugal

With an individual taxpayer number, the investor is able to open a bank account in a Portuguese bank. The investor needs to do it for future transactions. To open the account, one visits a Portuguese bank office.

With an individual taxpayer number, the investor is able to open a bank account in a Portuguese bank. The investor needs to do it for future transactions. To open the account, one visits a Portuguese bank office.

3—4 weeks

Fulfilling the investment condition

The investor transfers the money to the Portuguese bank account and then redirects it to the investment fund of their choice.

The investor transfers the money to the Portuguese bank account and then redirects it to the investment fund of their choice.

1—2 weeks

Collecting the required documents and submitting the application

The investor receives the full list of documents required to apply for a residence permit. The documents' electronic copies are sent to the Agency for Integration, Migration and Asylum, or AIMA.

The investor receives the full list of documents required to apply for a residence permit. The documents' electronic copies are sent to the Agency for Integration, Migration and Asylum, or AIMA.

5—6 months

Application processing

AIMA verifies all the documents submitted by the applicant and delivers the verdict.

AIMA verifies all the documents submitted by the applicant and delivers the verdict.

1—2 weeks

Submission of biometric data

The investor and other family members in the application travel to Portugal to submit original documents and fingerprints for residence permit cards. The appointment must be made in advance.

The investor and other family members in the application travel to Portugal to submit original documents and fingerprints for residence permit cards. The appointment must be made in advance.

4—6 months

Issuance of residence permit cards

The investor’s documents are examined once again. If the application receives the final approval, the applicant pays the fee for the residence permit cards, which are prepared within two weeks.

The cards are prepared within two weeks.

The investor’s documents are examined once again. If the application receives the final approval, the applicant pays the fee for the residence permit cards, which are prepared within two weeks.

The cards are prepared within two weeks.

Portugal Golden Visa fund investment for American citizens: a checklist

In light of the recent presidential election, US citizens are increasingly considering relocation options. Portugal is one of the prime destinations due to several factors: safety, warm climate, and a large expat community.

Additionally, Americans can apply for Portuguese citizenship five years after obtaining a residence permit. However, there are several things to consider beforehand.

1. Inform the state about a Portuguese bank account. One of the steps in the process of obtaining a Golden Visa involves transferring money to a local bank account. US regulations require all Americans to report foreign assets to the IRS.

2. Apply for a tax extension if needed. A US investor will most likely need to report their fund income at the end of April, which is later than when tax declarations are submitted in the US. This is due to the different tax calendars in the US and Portugal.

3. Understand tax obligations. Income received in Portugal is still taxed in the US for American citizens. The good news is that the investor is not required to pay dividends or capital gains tax in Portugal if they do not become a tax resident there.

Portuguese Golden Visa funds and crypto: latest updates

Portugal has been at the forefront of innovation in recent years. This is evident in the fact that the country was one of the first to adopt crypto regulation rules.

However, there is currently no direct way to obtain residency by crypto investment. Here’s what crypto holders should consider:

3CC Global Crypto Fund became the first crypto fund registered with the Portuguese regulator, CMVM. The fund invests in major cryptocurrencies such as Bitcoin, Ethereum, and Solana, with assets totaling €1 million.

Alessandro Palombo, the co-founder and CEO of Unbound Fund, suggested on X that possessing Bitcoin valued at €500,000 through the Unbound Fund might make one eligible for residency in Portugal.

Portuguese officials have not addressed Polombo’s proposal. There is still a chance such an option might be considered, if not utilised, in the future of Golden Visas.

Things to consider before investing in Portuguese Golden Visa funds

A good rule of thumb is to apply for the Portugal Golden Visa with a licensed agent. They will help an investor choose a fund, complete the transaction, and exit the fund after five years or more.

Here’s a checklist of questions to have answers to before applying:

Is my chosen fund eligible for the Golden Visa?

Is CMVM regulating the fund? Can I find the fund on the CMVM website?

What is the investment strategy of my fund, and what are my legal responsibilities?

Most of the funds can usually be found easily on the web. Their websites should provide information on when the fund was licensed by the CMVM and other important details for investors.

5 benefits of getting a Portugal Golden Visa by investment funds

1. Diversification. Applicants can split their €500,000 investment across multiple funds. Additionally, each fund is required to follow a diversified strategy, reducing risks for investors.

2. Safety. All the investment funds approved for the Portugal Golden Visa program are regulated by the Portuguese Securities Market Commission (CMVM) and the Central Bank. The rules stipulate that the Portuguese Tax and Customs Authority regularly audits fund managers. Such a high level of control ensures that all the funds must comply with the country’s laws.

3. Tax optimisation. Investors are exempt from dividends and capital gains tax in Portugal if they don’t become tax residents after obtaining a residence permit.

4. Potential of high returns. Annual yields from investment funds can be higher than income from other investment options. Most investment funds qualified for the program target an annual internal return rate (IRR) of 10—20%.

5. Professional management. After investing the money into fund units, the Portugal Golden Visa applicant allows a team of experts to manage all the transactions until the time comes to exit the fund.

Investment funds was an increasingly popular choice for Portugal Golden Visa applicants even before the law changes

Disadvantages of getting a Portugal Golden Visa by investment funds

1. Risks. Investors using investment funds to get a Portugal Golden Visa are not guaranteed to make a profit from their investments. While the fund manager is motivated to get a profit and earn their commission, investors alone bear the consequences if the value of their investment fund units depreciates by the time of their exit.

2. Lack of control. While some investors may be happy to allow a third party to manage their investment, this approach can be uncomfortable for others who prefer to keep their funds under full control. Ultimately, it comes down to trust between the investor and their fund manager.

3. Sharing profits. Any potential yields will be divided between the investors and the fund managers who take their commission. It can vary between funds but is normally at over 5% of all the profit generated by investment. Besides, most funds charge a subscription fee and an annual management fee.

4. Exit issues. Most investment funds contractually ensure the participants that the fund will not be dissolved before a certain period. Usually, it extends beyond five years, when the Portugal Golden Visa holders can obtain permanent residency in the country or its citizenship.

The investors’ funds are tied until the fund dissolves, making the fund units' resale very difficult. Funds can also trigger extension periods without consulting investors.

5. KYC requirements. Know Your Client is a standard practice in the investment and financial services industry, suggesting that investors present documents confirming the income, source, and legality. It might add layers of bureaucracy and make the procedure longer.

Key takeaways on Portugal Golden Visa funds investment

n investor can become a Portugal resident by contributing to an investment fund qualified for the Portugal Golden Visa program.

The minimum investment is €500,000, which can be spread across several investment funds. The minimum holding period is 5 years.

Purchasing investment fund units is high risk but high reward. Investors may earn more significant profits compared to other options. However, the investment value might depreciate.

A Portugal Golden Visa-qualified investment fund cannot specialise in real estate. However, investors are allowed to invest in agricultural, environmental, or other types of projects to be a Portugal Golden Visa applicant.

The Portugal Golden Visa allows the investor to reside in Portugal and obtain the country’s citizenship in 5 years.

Download our complete guide to learn everything you need about 9 popular Golden Visa programs.

Benefits

Investment options

Eligibility requirements

Processing times

Frequently asked questions

Investment funds have different thresholds for participants. However, the minimum investment to qualify for the Golden Visa program is €500,000, which is more than required by the funds.

Yes, the investment can be spread across several funds, but it should amount to a total of €500,000 to be eligible for the Golden Visa program.

Investors can’t purchase units in funds that are directly or indirectly linked with real estate development to obtain a Golden Visa. However, investment funds unrelated to real estate are still an option.

No, the only way for a foreigner to become a Portuguese citizen is by naturalisation. However, investing €500,000 in qualified investment fund units gives the investor the right to apply for a Portugal Golden Visa which, in turn, opens a path towards citizenship in five years.

Portugal investment funds are one of the options to obtain a Golden Visa. The minimum investment is €500,000. A less expensive option is a donation to a museum, gallery, or other cultural institution in Portugal. However, this option does not offer a return, unlike the investment option.

Investors are allowed to exit the fund in five years. It can be done later—when a fund’s lifecycle ends. This usually takes 7 to 14 years, depending on the chosen fund.

The returns from investment funds can be higher than those from other investment options eligible for the Portugal Golden Visa, if managed professionally. While profits are not guaranteed, most funds targeting the program aim for an annual return rate of 10 to 20%.

3CC Global Crypto Fund has become the first cryptocurrency fund registered with Portugal’s financial regulator, CMVM.

The fund invests in major cryptocurrencies, such as Bitcoin, Ethereum, and Solana, with total assets amounting to €1 million. However, there is no direct way to obtain residency in Portugal by buying crypto assets.

You can. The minimum investment is €500,000. The process involves the following steps: transferring the money to a Portuguese bank account and then forwarding it to the investment fund of your choice.

Currently, there are no special tax regimes for Portugal golden visa funds investors. The investor is not required to pay dividends or capital gains tax if they do not become a tax resident in Portugal after obtaining a residence permit.

It mostly depends on the type of fund chosen. Most investment funds from the Portugal Golden Visa investment funds list target an annual internal return rate of 10—20%. Despite that, the profit is not guaranteed.

To apply for a Golden Visa in Portugal, investors are able to make fund investments. A qualifying investment fund in Portugal is a regulated fund that meets government criteria, such as targeting economic growth. The fund can invest in various asset types at the same time, including commercial properties and industrial facilities.

The Portuguese Securities Market Commission ensures compliance with the investment strategies. Every Portugal Golden Visa qualified investment fund should be properly licensed by CMVM.